A short sale property is one that is sold at a price that is less than the debt owed on the property. Lenders frequently accept a discount on the amount owed to avoid a possible foreclosure or bankruptcy. As an example, a homeowner, who is facing foreclosure, or who just wants to walk away from an underwater home, has an existing first mortgage of $300,000. The market tells you the house is only worth $245,000. You offer to purchase the home for $220,000. Then seller will then try to talk the bank into accepting these proceeds as payment in full for the outstanding loan. If the bank accepts, then the sale can go forward and this is called a short sale.

Why would the lender be willing to take such a discount in a short sale? Several reasons. First, banks do not like excess inventory and bad loans on their books. Therefore, if they see an opportunity where they can sell the property without a huge loss, they will do it. Secondly, lenders know they could lose a lot more money if the property goes to foreclosure. There are so many fees involved if the property goes to foreclosure, that they would be better off taking the discount beforehand through a short sale and be finished with the headache of it all.

Many lenders will accept a short sale. However, you may come across some lenders who will not agree to a short sale. If the numbers work out for the lender they will do it. But it is not always an easy and quick process. It can take a long time. Once a buyer first contacts the lender to negotiate a short sale price, it can take several months to get an answer. Lenders have special committees that review these matters and they definitely take their time. And until there is an offer from a prospective buyer, many banks will not even consider it. So, as a prospective seller of a short sale property, one may want to attempt initial short sale negotiations with the lender before listing the property. If the lender allows this, then the lender can conduct all it’s internal reviews and make a price decision prior to the home being listed. In this situation, once an offer is made on the home, then it should be a quick and simple matter to push this through. As a prospective buyer of a short sale property, one may want to search for a short sale property that has already been through the lender approval process. Many listings will refer to these properties as “pre-approved” short sales, or something similar.

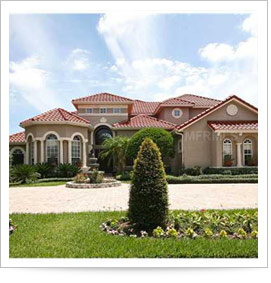

It does not matter what type of house or condition it’s in. All properties can be considered for a short sale. The best properties to perform a short sale on are the houses that need lots of work and repairs, because lenders will give you a bigger discount if they see a house that is continuing to drop in value.

Short sales in Orlando are abundant and can provide a wonderful investment to a buyer and a wonderful relief to a prospective seller. But there are many factors to consider. So you need to find a qualified real estate agent to aid you. Please contact the real estate and legal team at YourOrlandoRealty.com for more information on short sale properties in Orlando and the Central Florida area.